Imagine the following situations:

- John decided to open a company. He invested $20,000 to buy raw materials. In the first month of operation, he used $5,000 worth of raw materials and had $25,000 of total sales, he also has $10,000 of bills to pay.

- You own a computer that is worth $5,000 if you sell it today. You bought it for $7,500 and paid $4,000 so far. Apart from that, you have $2,000 in your checkings account and $1,500 of bills to be paid.

Assets and Liabilities

All persons and companies usually own some stuff and also owe some stuff.

In accounting, all the stuff we own are called "assets", and all the stuff we owe are called "liabilities".

In the first example above, John's company has $40,000 worth of assets and $40,000 worth of liabilities. In the second example, you would have $7,000 worth of assets and $7,000 worth of liabilities. Yeah, I know, it doesn't make sense yet, but I'll explain it.

The Accounting Equation

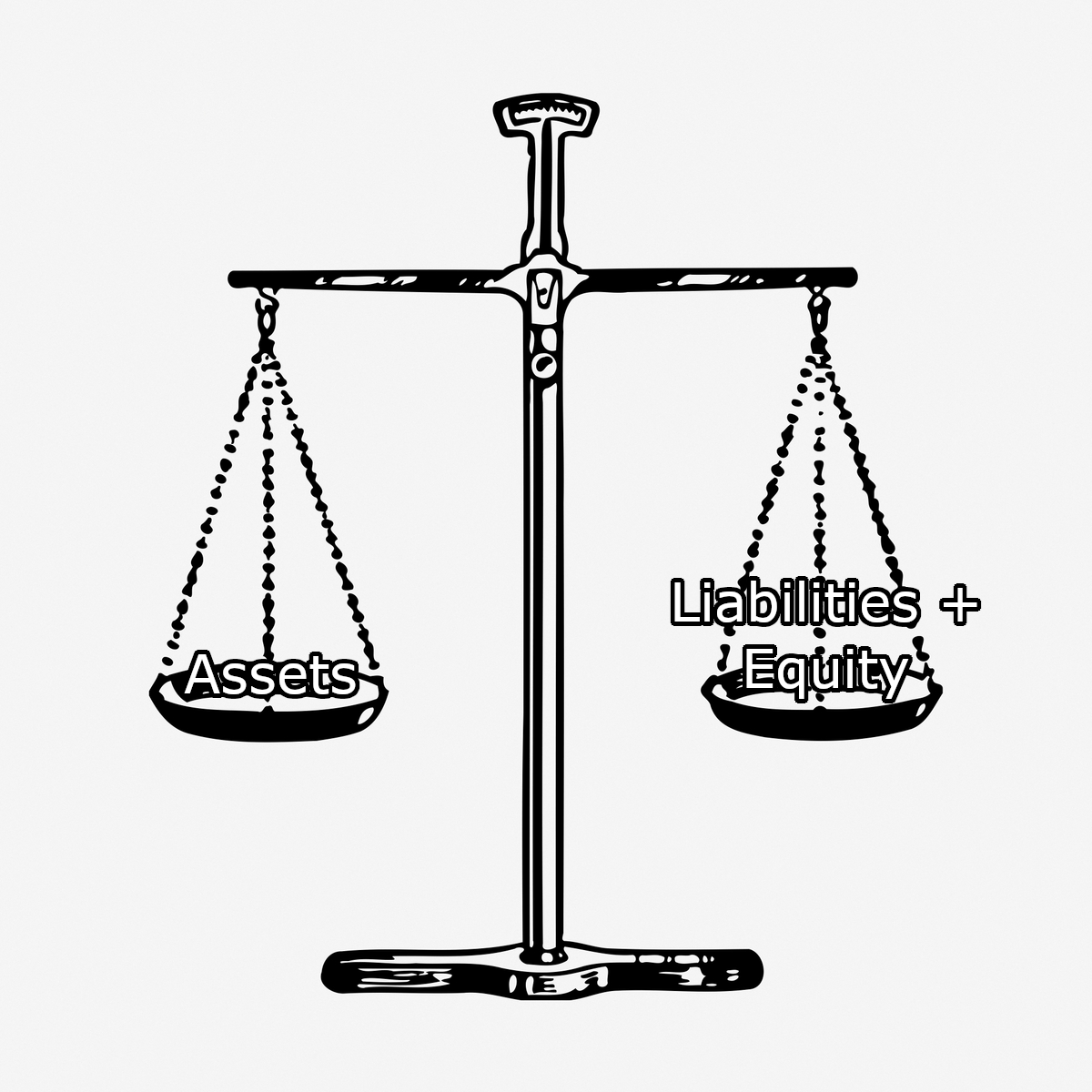

In the world of accounting, everything must be in balance. Imagine accounting as an old scale where both sides must always be at the same height.

This balance is represented by the accounting equation:

Assets = Liabilities + Equity

For a company, the equity represents how much the company owes to the shareholders, and for a person, it represents how much money you actually have.

Sometimes we can find the equation expressed a little bit differently, but in the end it still represents the same concept: "Equity = Assets - Liabilities", which makes sense because it basically means that your equity is everything you own subtracted by everything you owe.

Now that we know that the accounting equation demands balance, let's get back to the examples and demonstrate them as code. Remember that the point here is to explain the concepts, so please don't mind the Asset and Liability classes adding nothing to the parent class' behavior.

import type { MoneyFacade } from "./money";

import money from "./money";

export abstract class Priceable {

constructor(private _name: string, private _value: MoneyFacade) {}

get name() {

return this._name;

}

get value() {

return this._value;

}

}

// An asset is something priceable

export class Asset extends Priceable {

constructor(name: string, value: MoneyFacade) {

super(name, value);

}

}

// so is a liability

export class Liability extends Priceable {

constructor(name: string, value: MoneyFacade) {

super(name, value);

}

}

export function sum(items: Priceable[]) {

return items.reduce((total, item) => {

return total.add(item.value);

}, money("BRL", 0));

}import { Asset, Liability, sum } from "../src/asset_liability";

import money from "../src/money";

test("Example 1", () => {

// John decided to open a company. He invested $20,000 to buy raw

// materials. In the first month of operation, he used $5,000 worth of

// raw materials and had $25,000 of total sales. He also has $10,000 of

// bills to pay.

const assets: Asset[] = [

new Asset("Raw materials", money("USD", 15_000_00)),

new Asset("Total sales", money("USD", 25_000_00)),

];

const liabilities: Liability[] = [

new Liability("Bills to pay", money("USD", 10_000_00)),

];

// The equity is a liability because the company must return it to the

// shareholders

const equity: Liability[] = [

// The capital stock is part of the equity. When John decided to open a

// company, he made an initial investment of $20,000. This is the

// capital stock of the company, and the company owes this money to

// John. If the company owes this to John, then it is a liability

new Liability("Capital stock", money("USD", 20_000_00)),

// The profit (or the loss) is the difference between the all the other

// assets and liabilities, and it gives the balance to the equation

new Liability("Profit", money("USD", 10_000_00)),

];

const leftSideOfTheEquation = sum(assets);

const rightSideOfTheEquation = sum(liabilities).add(sum(equity));

expect(leftSideOfTheEquation.isEqualTo(rightSideOfTheEquation)).toBe(true);

});

test("Example 2", () => {

// You own a computer that is worth $5,000 if you sell it today. You bought

// it for $7,500 and paid $4,000 so far. Apart from that, you have $2,000

// in your checkings account and $1,500 of bills to be paid.

const assets: Asset[] = [

new Asset("Computer", money("USD", 5_000_00)),

new Asset("Money in the checkings account", money("USD", 2_000_00)),

];

const liabilities: Liability[] = [

new Liability(

"Installments payable for the computer",

money("USD", 3_500_00)

),

new Liability("Bills to be paid", money("USD", 1_500_00)),

];

// In the case of a person, the equity is how much money you actually have

// It is the value of your assets subtracted by all your present and future

// expenses

const equity: Liability[] = [

new Liability("What you actually have", money("USD", 2_000_00)),

];

const leftSideOfTheEquation = sum(assets);

const rightSideOfTheEquation = sum(liabilities).add(sum(equity));

expect(leftSideOfTheEquation.isEqualTo(rightSideOfTheEquation)).toBe(true);

});You can find the source code here.

That's it for today! I'll post the third article soon. Later!